It is worth noting that you can print or email this $ 39,000.00 salary example for later reference. There is a lot of detailed information which is worth reading and using as a reference, particularly if you file your own tax return without using a tax return software provider and/or accountant. All financial information is encrypted and sent over HTTPS using TLS. Any credit / debit card information that is stored is secured using PCI DSS Level 1 compliant standards. These systems are audited by third party organizations twice a year to ensure the highest levels of security are being met and maintained.

- Your net pay is essentially your gross income minus the taxes and other deductions that are withheld from your earnings by your employer.

- If you’re self-employed your FICA rates are doubled, since you’re paying on behalf of both the employee (you) and the employer (also you).

- This income tax calculation for an individual earning a 39,000.00 salary per year.

- For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck.

Paycheck calculators by state

We do not accept liability for any errors or omissions, please read our disclaimer and terms and conditions of use. Non-business Energy Property Credit–Equipment and material that meet technical efficiency standards set by the Department of Energy can qualify. The first type is defined as any qualified energy efficiency improvements, and examples include home insulation, exterior doors, exterior windows and skylights, and certain roofing materials.

Salary Paycheck Calculator – 2024 US Federal

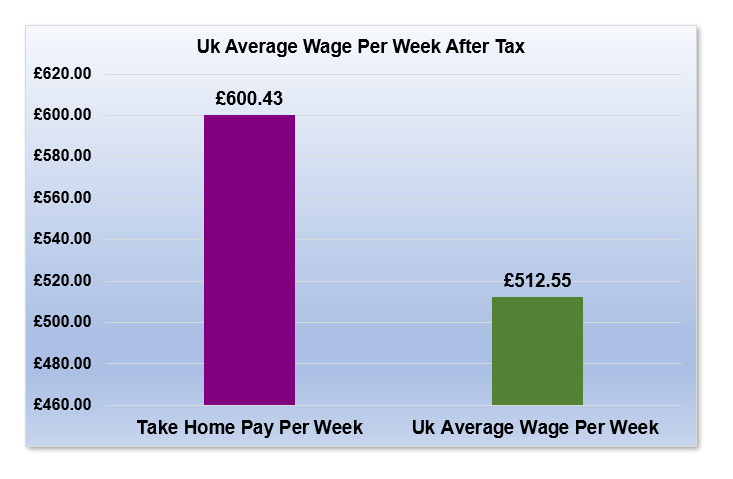

Also, a bi-weekly payment frequency generates two more paychecks a year (26 compared to 24 for semi-monthly). While a person on a bi-weekly payment schedule will receive two paychecks for ten months out of the year, they will receive three paychecks for the remaining two months. Tax and National Insurance are not the only deductions from the average payslip – you could also have pensions, student loans, company car taxes and much more. Click the ‘edit tax calculation’ button above or click here to change the gross income and/or add your options to tailor the calculation precisely. The calculation above shows that, after tax, a gross income of £39,000 per year in 2024 leaves you with £31,601 taken home.

$39,000 a Year Is How Much an Hour? Is It a Good Salary?

If you work 5 days per week, this is £119.50 per day, or £14.94 per hour at 40 hours per week. All residents and citizens in the USA are subjected to income taxes. Residents and citizens are taxed on worldwide income (working overseas, etc.).

How Should I Budget a $39,000 Salary?

Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52. That’s because your employer withholds taxes from each paycheck, lowering your overall pay.

US Tax Calculation for 2024 Tax Year

Some deductions are “post-tax”, like Roth 401(k), and are deducted after being taxed. Saver’s Credit–Non-refundable credit incentivizes low and moderate-income taxpayers to make retirement contributions to qualified retirement accounts. 50%, 30%, or 10% of retirement account contributions up to $2,000 ($4,000 if married filing jointly) can be credited, depending on adjusted gross income. Must be at least 18, not a full-time student, and cannot be claimed as a dependent on another person’s return.

Just like rent, your mortgage payment should be a maximum of one-third of your income. Now, what if you have a salaried position with two weeks of paid vacation time each year? That means that you are working 2000 hours turbotax guide to filing an amended return with the irs a year, and increases your hourly rate. Also calculated is your net income, the amount you have left over after taxes or paid. On a £39,000 salary, your take home pay will be £31,071 after tax and National Insurance.

This breakdown will provide you with a comprehensive understanding of how your income is distributed across different timeframes. Updated to include income tax calculations for 2022 form 1040 and, 2023 Estimated form 1040-ES, for status Single, Married Filing Jointly, Married Filing Separately, or Head of Household. Then, we apply the appropriate tax bracket and rate(s) based on taxable income and filing status to calculate what amount in taxes the government expects you to pay. It is important to make the distinction between bi-weekly and semi-monthly, even though they may seem similar at first glance. For the purposes of this calculator, bi-weekly payments occur every other week (though, in some cases, it can be used to mean twice a week).

That means that after taxes you will have an hourly wage of $14, which is above the minimum wage. If you know the tax rates for your state and your circumstances you can modify the equation above to determine what your hourly pay is after taxes. If your salary is £39,000, then after tax and national insurance you will be left with £30,542. This means that after tax you will take home £2,545 every month, or £587 per week, £117.40 per day, and your hourly rate will be £18.75 if you’re working 40 hours/week. You need to understand which tax bracket you belong to based on your taxable income and filing status. Some people get monthly paychecks (12 per year), while some are paid twice a month on set dates (24 paychecks per year) and others are paid bi-weekly (26 paychecks per year).

I enjoy how easy and beautiful the website is, the data base is efficient and useful, people (especially outside our church) enjoy using the giving option. We saw giving increase the very first month we started using Tithe.ly. Allowing members to give from their mobile devices is huge and the the automated recurring giving feature has been very well received.